Amazon

2016 - 2019

In 2016, I started my first full time research role on the Vendor Experience team at Amazon. I primarily worked on improving the experience of the Vendor Central platform, where businesses would handle all of their Amazon related inventory, marketing, and finance tasks. My work was a balance of heavily quantitative studies as well as in-depth qualitative projects.

Ecommerce Shopping - Reorder Experience

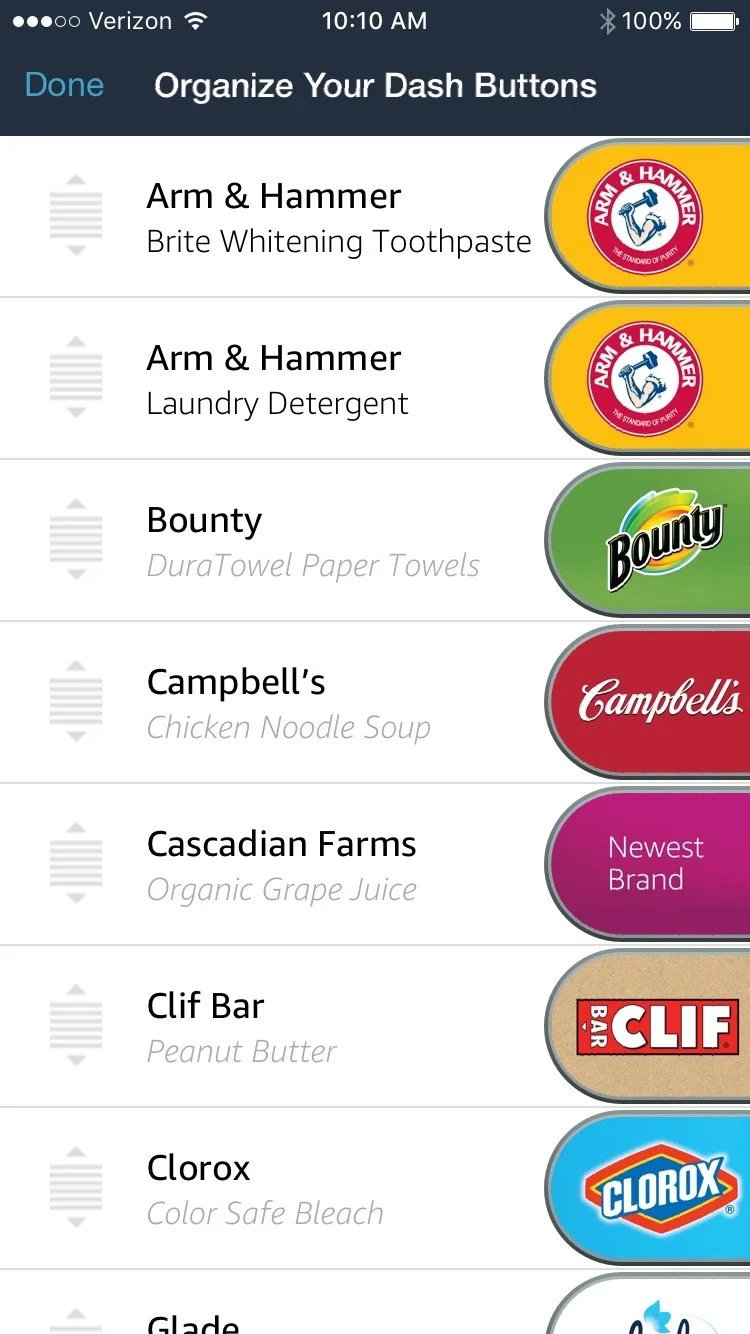

Before working with Vendors, I am proud to say my very first project successfully launched on the Amazon.com homepage. To facilitate online shoppers' re-ordering processes, the design team decided to create a digital facsimile of dash buttons, one-touch re-ordering devices.

The success of digital dash buttons heavily depended on the discoverability and understandability of the feature. As the researcher for this project, I organized multiple rounds of usability testing with early low-fidelity paper prototypes through to working code personalized to each participant. I also conducted large sample surveys with internal employees adding small homework assignments afterwards.

In all, across multiple studies I tested with over 80 participants in person and analyzed data from another 350 assignments, successfully providing data to place the dash buttons in prominent locations throughout Amazon.com. Findings from my research also helped to prioritize the types of products consumers would most likely reorder, enabling the team to generate a personalized initial set of dash buttons for every Amazon shopper.

Vendor Central eCommerce - Platform Design

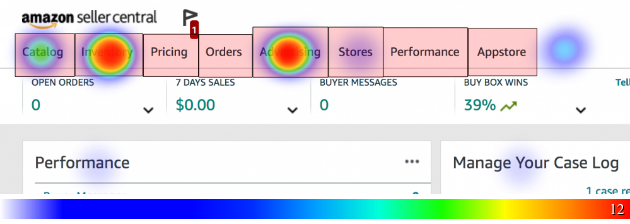

Amazon’s Vendor Central (VC) platform encompasses all aspects of conducting business through the Amazon marketplace. Vendors world-wide contractually provide product, coordinate logistics, launch and manage marketing campaigns, access invoicing, and analyze financial data from within the VC platform itself, creating hundreds of use cases from every aspect of business administration.

Many of VC’s features and much of its functionality retained their original designs from the early 2000s, creating inefficiencies and long onboarding time for users. I worked directly with the design team to conduct research for new designs across all aspects of Vendor Central.

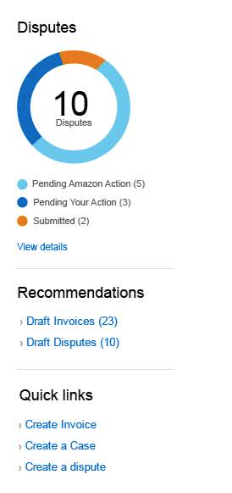

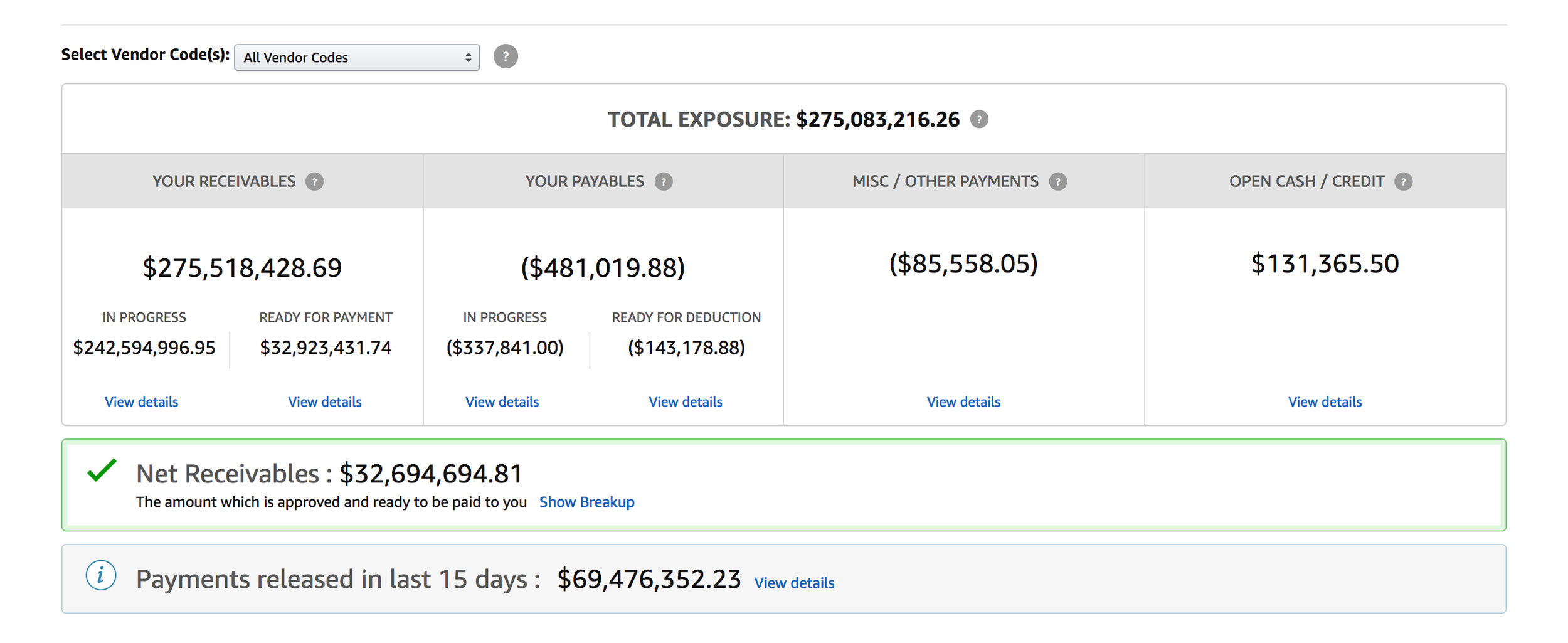

As an example, the payments and invoice section of Vendor Central was one of the most problematic areas of the experience based on contact data. A design team in India created a prototype that would link payments, invoices, and purchase orders together across different pages, greatly reducing the efforts from vendors to track these documents.

I recruited seven users from vendors ranging from small regional businesses to world-wide conglomerates to test a prototype primed with their actual vendor financials. I found that the new interactions as well as improved visual designs and information hierarchy could reduce the time spent assessing financial data by vendors by nearly 4 man-hours per week.

Vendor & Seller Central - Roles & Permissions

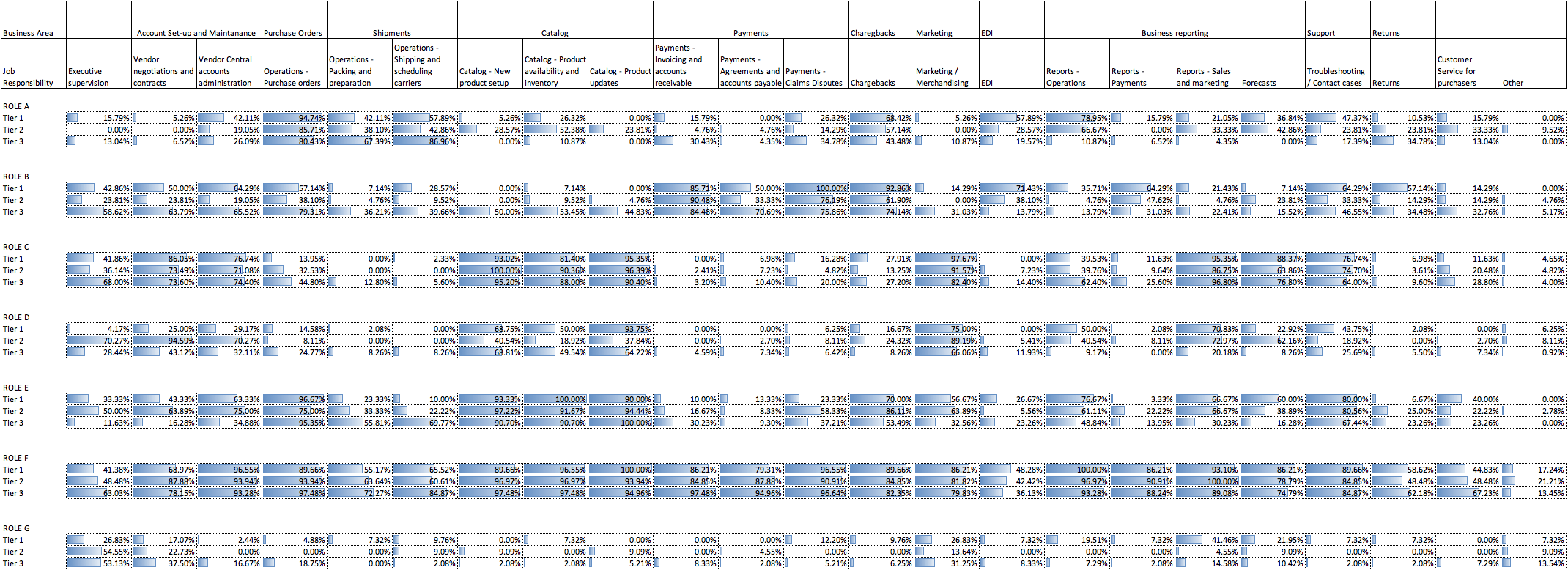

Due to the comprehensiveness of Vendor Central, users typically focused on subsets of tasks within the platform. Until 2018, there had been no efforts to stratify VC users based on their usage of the platform.

Understanding how vendors assign tasks to their employees using the platform would enable better targeting of research efforts, better understanding of how design changes would impact the most relevant users, and better platform management of roles and permissions.

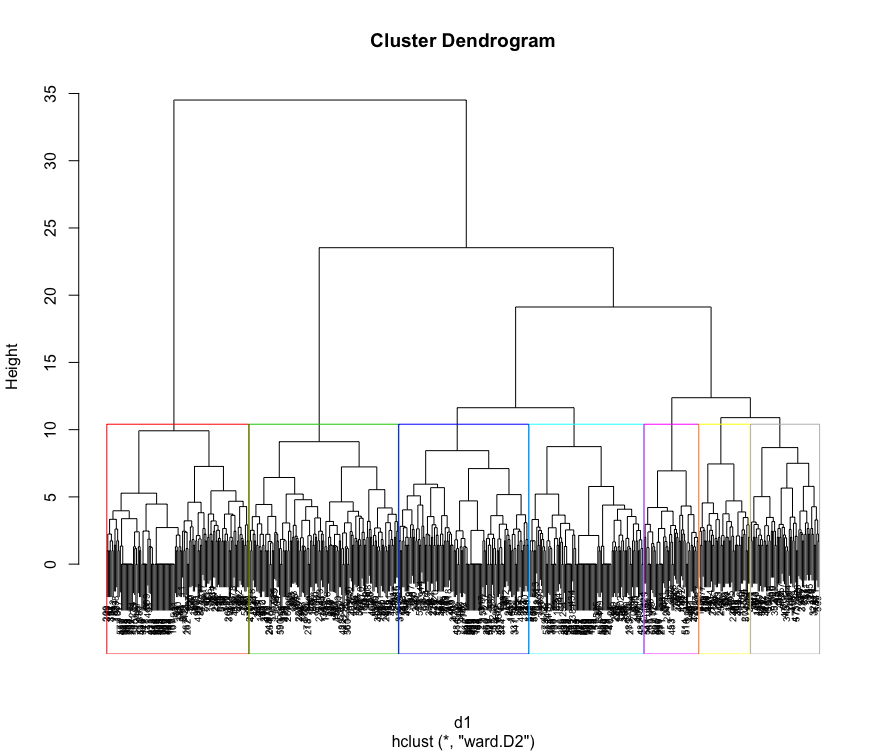

I worked with another researcher to create a nearly year-long research plan to discover, refine, and analyze vendor central user cohorts using a standard double-diamond research approach.

After an initial pilot survey, I collected data from the world-wide vendor satisfaction survey and performed cluster analysis to identify 7 unique cohorts of vendor central users. To verify how well these roles align in reality, my research partner and I conducted field visits across the US, finding the roles accurately described user types.

After some refinement, I was able to create questions to identify user types for study screeners and surveys moving forward, enabling research data to be accurately attributed to the users most relevant to a topic.

Vendor Satisfaction -

World-wide Survey & Polling

One of my major duties in the Retail org was to conduct a biannual world-wide vendor satisfaction (VSAT) survey that acted as a snapshot for the organization’s performance as well as providing data to prioritize upcoming projects and decisions during annual planning.

When I took ownership of the VSAT in 2017, the survey averaged 145 questions including 50 free response questions and was sent out to 9 different countries in local languages. Respondents were paid $5 for completing the survey, and with over 10,000 responses per year the survey accounted for a significant expense to the research team.

I created several tools and templates to analyze the immense volume of data, including excel sheets to statistically analyze all likert questions. I even created a free-response analyzer to identify themes across hundreds of qualitative responses and add sentiment analysis.

I was tasked with improving the survey design and maintaining the data quality while removing the gratuity for respondents. By making use of extensive branching logic, tweaking survey language, and focusing on the survey taking experience, I was able to improve data quality and minimize reductions in responses while eliminating the gratuity.

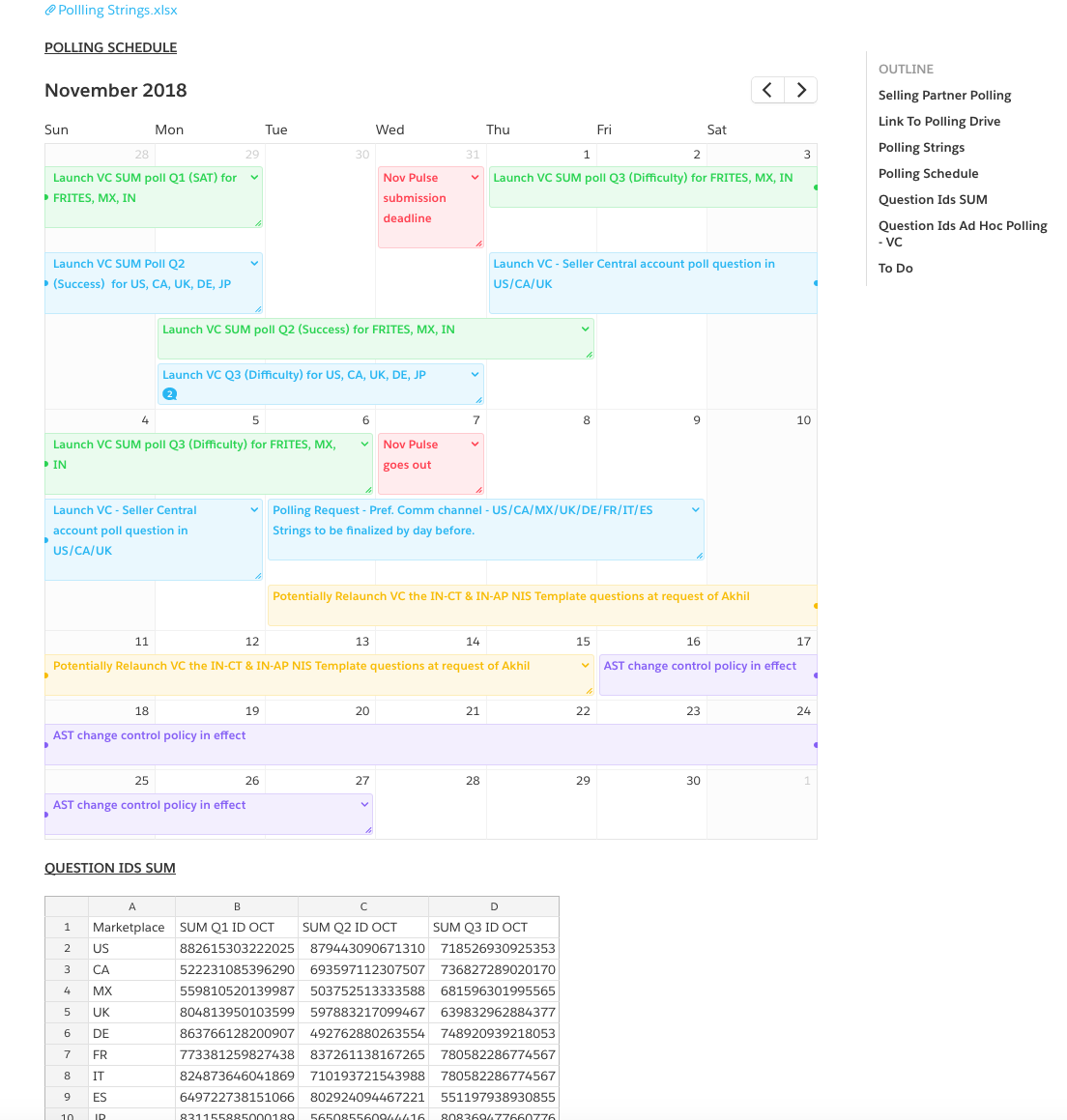

I next took ownership of a fledgling polling tool within Vendor and Seller Central, and began to migrate the biannual VSAT survey to weekly on-site surveys. Eventually eliminating the need for the large VSAT survey, I expanded and managed the polling service. I worked with a data analyst to automatically pull polling data from a Redshift cluster into a self-service Tableau dashboard, and I began preparing a monthly pulse report that enabled more frequent and timely sampling of selling partner satisfaction.